The Facts About Hard Money Atlanta Uncovered

Table of ContentsThe 9-Minute Rule for Hard Money AtlantaGetting My Hard Money Atlanta To WorkThe Buzz on Hard Money AtlantaFascination About Hard Money Atlanta

Considering that tough money loans are collateral based, additionally called asset-based financings, they call for very little documents as well as enable financiers to enclose a matter of days. However, these lendings included even more risk to the lender, and as a result call for greater down settlements and also have higher rate of interest than a standard lending.Several conventional loans may take one to two months to shut, but difficult money loans can be shut in a few days.

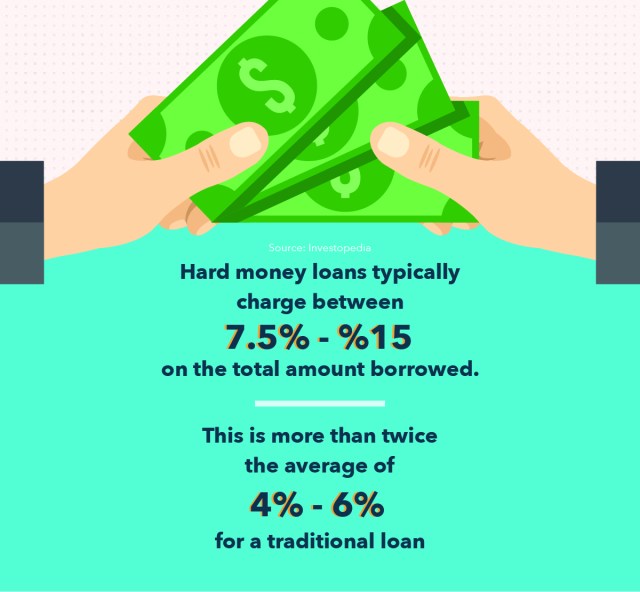

Many difficult cash loans have short settlement durations, generally between 1-3 years. Conventional mortgages, in contrast, have 15 or 30-year payment terms usually. Hard cash car loans have high-interest rates. A lot of hard cash loan rates of interest are anywhere between 9% to 15%, which is dramatically greater than the rates of interest you can anticipate for a traditional home mortgage.

When the term sheet is signed, the lending will be sent out to handling. Throughout finance processing, the lender will ask for papers as well as prepare the lending for last loan review and also schedule the closing.

Hard Money Atlanta Things To Know Before You Buy

You'll require some funding upfront to get approved for a difficult money car loan and the physical property to work as security. This can make difficult cash loans inaccessible for some capitalists or homeowner. Additionally, difficult cash financings generally have higher rates of interest than conventional mortgages. They are likewise interest-only car loans which suggests your regular monthly repayment just covers rate of interest as well as the major quantity will certainly be due at maturation as a swelling amount.

Common exit methods include: Refinancing Sale of the asset Payment from other resource There are lots of scenarios where it might be beneficial to use a hard money car loan. For beginners, investor who such as to house turn that is, acquire a review house in need of a great deal of work, do the work directly or with professionals to make it a lot more important, after that turn around and also market it for a greater price than they acquired for may locate hard money fundings to be optimal funding choices.

As a result of this, professional home fins typically like short-term, busy funding services. Home fins generally attempt to market residences within much less than a year of acquiring them. As a result of this, they don't need a long term as well as can avoid paying way too much interest. If you purchase investment buildings, such as rental residential or commercial properties, you may likewise locate difficult money car loans to be excellent choices.

Rumored Buzz on Hard Money Atlanta

In some situations, you can also use a hard cash lending to acquire vacant land. Note that, also in the above circumstances, the prospective negative aspects of tough cash fundings still use.

If the phrase navigate here "tough cash" inspires you to begin quoting lines from your favored mobster flick, we would not be shocked. While these sorts of loans might appear hard as well as intimidating, they are a typically used funding technique numerous investor make use of. Yet what are tough money lendings, and also exactly how do they work? We'll clarify all that as well as much more here.

Hard money loans generally come with greater interest prices and shorter payment routines. Why choose a hard money financing over a conventional one?

Indicators on Hard Money Atlanta You Need To Know

Furthermore, because personal people or non-institutional webpage lending institutions provide tough money loans, they are exempt to the very same regulations as traditional lending institutions, which make them much more risky for customers. Whether a tough cash financing is best for you depends on your circumstance. Difficult cash fundings are great alternatives if you were denied a conventional finance and need non-traditional financing.

Get in touch with the professional mortgage experts at Right Start Mortgage to learn more. Whether you wish to acquire or re-finance your residence, we're below to aid. Begin today! Ask for a cost-free individualized rate quote.

The application process will typically involve an assessment of the residential property's worth as well as capacity. In this way, if you can't afford your payments, the difficult money lending institution will merely continue with selling the home to recover its financial investment. Difficult cash loan providers generally bill greater rates of interest than you 'd carry a conventional funding, yet they also money their loans website here quicker as well as typically require much less paperwork.

As opposed to having 15 to three decades to pay off the finance, you'll commonly have just one to five years. Hard money fundings function rather in a different way than conventional fundings so it's essential to understand their terms and also what transactions they can be made use of for. Difficult money car loans are normally meant for financial investment residential or commercial properties.